[ad_1]

New Delhi. Global brokerage firm Nomura has advised to invest money in the shares of Inventorous Knowledge Solutions (IKS Health Share), which provides services to healthcare enterprises. The brokerage estimates that this share can achieve a gain of 27 percent from the current price. Today, on Monday, November 24, it is trading at Rs 1596 on NSE with a rise of 1.79 percent. In the last one month, this stock has increased by about five percent and till now in the year 2025, it has fallen by about 18 percent. Its price has fallen by 18.66 percent in a year. Veteran investor Rekha Jhunjhunwala has also invested in Inventrous Knowledge Solutions shares.

IKS Health was listed in the stock market in December 2024. Its IPO of Rs 2,497.92 crore was filled 52.68 times. Rekha Jhunjhunwala has 0.23% stake in the company. Apart from this, Jhunjhunwala family had 16.37% stake in the company till September 2025 through 3 discretionary trusts – Nishtha, Aryaveer and Aryaman. The company’s standalone revenue in the July-September 2025 quarter stood at Rs 355.69 crore. Net profit was recorded at Rs 138.40 crore. In FY 2025, standalone revenue was Rs 973 crore and net profit was Rs 331.95 crore.

Inventrous Knowledge Solutions Share Target Price

Nomura has initiated coverage of Inventrous Knowledge Solutions shares with ‘Buy’ rating and set its target price at ₹2,000 per share. This target is 27% more than the closing price of this share on Friday. Nomura says IKS Health’s earnings per share will grow at a CAGR of 32% from FY25 to FY28. The company provides a care enablement platform for physician enterprises in the US, Canada and Australia. Its main focus is on the US market. It provides services to more than 778 healthcare organizations.

Promoter’s stake is 63.7%

According to the company’s shareholding pattern for the September quarter, the largest shareholder is still the promoter group, whose stake remains stable at 63.7%. The share of public shareholders is 21.9%. This shows active participation of retail investors in the company. FII/FPI has increased its stake in Inventrous Knowledge Solutions from 6.50% to 7.02% in the September 2025 quarter. Mutual funds have increased their stake from 1.93% to 2.26% in the September 2025 quarter. Overall, this shareholding pattern shows that the promoters have strong control over the company, while the interest of public and foreign investors is also balanced.

The company is generating high returns

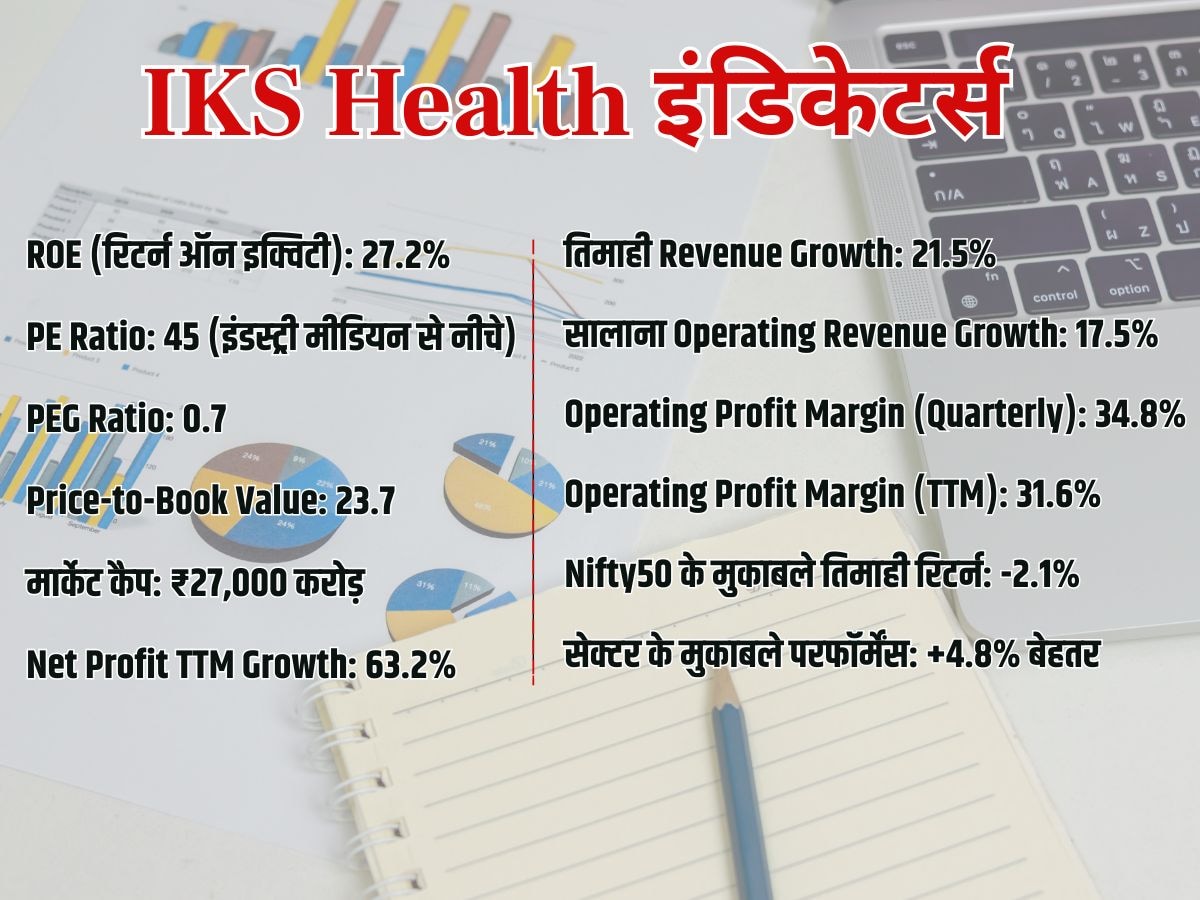

Many important signals are coming from the latest financial and market indicators of Inventrous Knowledge Solutions. According to Trendlyne data, market capitalization has been recorded at Rs 27 thousand crores. The company’s performance is maintaining investor confidence, although some parameters are also indicating caution. The company’s ROE of 27.2% places it in the category of high-return generating companies. At the same time, Piotroski Score 6 also indicates that the balance sheet and fundamentals of the company are in a strong position.

The company’s PE ratio is 45, which is below the industry median. However, the PEG ratio of 0.7 is considered better and indicates that the valuation is still balanced compared to the company’s growth. On the contrary, the price to book value of 23.7 is quite high, which indicates that the stock is in the overvalued zone. The company’s net profit TTM growth has reached 63.2%, which brings it in the high-performance category. Talking about revenue, the company’s revenue growth on quarterly basis was 21.5%, but it is below the sector median. Whereas Operating Revenue Growth on annual basis is 17.5%. The company’s operating profit margin on quarterly basis is 34.8% and TTM margin is 31.6%, which reflects the efficiency and cost control of the company.

Weak returns compared to Nifty

Inventures Knowledge Solutions quarterly performance as compared to Nifty50 has been -2.1%, which means the company has performed weakly compared to the broad market. However, compared to its sector its performance has been 4.8% better. The company’s financial numbers point to strong growth, high margins and better returns, but high price-to-book value and weak quarterly performance compared to the market also indicate caution for investors.

(Disclaimer: The stocks mentioned here are based on the advice of brokerage houses. If you want to invest money in any of these, then first consult a certified investment advisor. AyraNews24x7 will not be responsible for any profit or loss of yours.)

[ad_2]